Practical Summary:

- Instacart recently repriced its shares to reduce its valuation by 40%.

- This move makes great sense for the company, given where all of its public market comparables have traded since the company’s last financing in early 2021.

- This voluntary re-pricing is a great recruiting tool for the company.

- We don’t think that Instacart will be alone in revaluing its shares.

Recently, Instacart made headlines when its valuation was slashed by ALMOST 40%, from $39B to $24B.

The grocery-delivery startup had been valued at $39B in its most recent fundraising round, when it snagged $265M last year from investors such as Andreessen Horowitz, Sequoia Capital, D1 Capital Partners, and crossover investors Fidelity Management & Research Co. and T. Rowe Price Associates Inc.

Why Did Instacart Do This?

There are several reasons why a startup would reduce its valuation. Sometimes a company needs to adjust its valuation to reflect its business results. Startups occasionally are forced by new investors to raise capital at a lower valuation than the prior rounds – the dreaded “down round.” For instance, two years ago, fashion startup Rent the Runway Inc. raised funding at less than its $1B valuation at the time, during the early days of the pandemic.

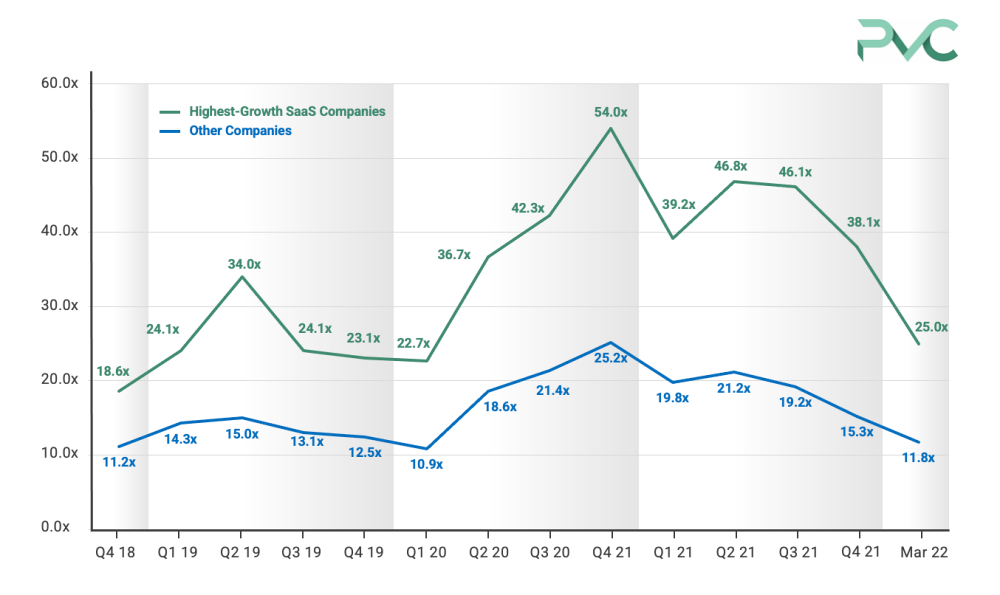

This situation is a bit different – the broad market has adjusted sharply since Instacart last raised in May 2021. My firm tracks a basket of US-listed tech stocks in the SaaS category (the PVC SaaS Index, which is comprised of all SaaS companies with IPOs since 2016). We’ve seen multiples compress by as much as 50% since their peak mid-last year; the highest-growth SaaS companies have been hit even harder. Other eCommerce enablers are down even more, such as Shopify Inc. (NYSE: SHOP) off by 59% from its 52-week high; BigCommerce Holdings, Inc. (NASDAQ: BIGC) off by 68%; and PayPal Holdings Inc (NASDAQ: PYPL) off by 62%.

Figure 1. Median SaaS multiples since Q4 2018 (mean EV / TTM sales by growth rate for SaaS companies that IPO’ed 2016 and later). The highest growth companies delivered 50% or more revenue growth in the last 12 months and continue to project similar growth into next year. (Source: PVC SaaS Index – Q1 2022 Valuation Update)

When a company’s publicly traded comparables decline in value by this much, the company’s auditors and tax advisers will usually stress test a privately held company’s valuation. Every company that gives employees any kind of equity-linked compensation (e.g., stock options, RSUs, or outright share grants) has to estimate the fair value of those stock grants, whether the company is publicly or privately held. These annual valuations determine things like stock compensation expense and also the company’s (and employees’) tax liability in future years.

So it’s quite possible that Instacart was pushed to reduce its own valuation by auditors.

Many startups will dig in and seek to justify their prior valuation in the face of these pressures, but I think that there are some good reasons for startups to take this opportunity to voluntarily reprice.

Implications for Different Stakeholders

First, let’s consider the impact on Instacart’s existing shareholders. Two of their largest shareholders are Fidelity Management & Research and T. Rowe Price. Both of these money managers are publicly traded and have to revalue all of their holdings (public and private) every year. Purely because of the market comps issue described above, they were likely going to take a 40% write-down (an “unrealized loss” in the parlance of the accounting industry) anyway.

Other big shareholders are Sequoia Capital, D1 Capital Partners, and Andreessen Horowitz. All of these investors have been long-term “buy and hold” investors – smart, patient, sophisticated capital that won’t worry about an unrealized loss (just the opposite, these firms might appreciate a startups’ concession to a market-driven reality).

But most importantly, a proactive repricing will have a very positive effect on recruiting.

Any new hires will now receive stock options at a lower strike price, which means that they have more equity upside in the company. If a company artificially keeps it valuation high, new employees who receive stock options receive less in terms of their expected financial win, and that’s less reason to stick around.

I suspect that recent hires whose options are now less compelling will also receive new grants, to ensure fairness and to keep them motivated.

All of that is a big deal because talent is the most important determinant of a startup’s success, and right now the war for talent is as fierce as I’ve ever seen it.

There are lots of reasons to work for a company (the people, the mission, the health coverage, the free food, the slide in the lobby), but really, equity incentives usually trump all of those benefits. And on that score, working at Instacart just became a whole lot more attractive.

Conclusion

Valuations of companies will rise and fall, based on market movements beyond their control. Its short-term thinking that makes a company dig in and fight that reality by protecting a previous valuation against the bumps and turbulence of the market.

Instacart has taken a smarter, long-term approach to create a more attractive equity upside for their employees.

Expect other startups to take a similar approach, either because they’re being pressed by their auditors or by new investors, or because they too see the benefit of having reasonably priced stock to use as a recruiting tool.