Why I needed a side hustle?

It’s early 2017 – I’m midway through my stint at Google. It took about 12-18 months, but I was finally “comfortable” with the pace of my job. While I still enjoyed my role, I was now able to handle the day-to-day with less time and energy than when I started. What used to take me 50 hours now took 30 hours or less. For some of you, the pandemic has been a forcing function that has led to a similar result.

Looking back, there was a stretch of time where I spent 10+ hours/week playing Super Smash Bros and table tennis. Absolutely no regrets, but needless to say, I had some bandwidth after feeling solid at work. Contributing force #1: excess time.

Another contributing force was constantly being surrounded by high-achievers who all seemed to have a side-gig. John, a superstar at work, was teaching in the evenings to those less fortunate. While Sally, who had a side-business advising clients on going mobile-first, was still scoring at least Exceeds Expectations on every performance review.

While the names are fictitious, the anecdotes (and the feeling of inferiority) were very much real. Everyone around me seemed to have a side hustle..all while still excelling at the almighty Google. Being content in my role felt like a societal penalty, “If I’m not doing multiple things, then I’m being complacent,” I thought; and complacency was akin to getting left behind. We could dedicate an entire article on this paradigm. But for now: Contributing force #2: pressure of inferiority.

But why real estate?

In exploring different resource groups to see the side hustles of others, I came across the concept of FIRE (Financially Independent, Retire Early). It was all the rage. It was sexy. It was the thing. Have a side hustle > build passive income > be free. Seemed simple. After all, who wants to work forever? A majority of the FIRE posts were in the real estate arena, so I narrowed further research there.

I learned Real Estate has four primary ways of income generation. Most people understand the first two items well:

- Cash flow – rent, less expenses

- Appreciation – increasing property value over time

- Amortization – paying down loan principal each month (either by you or a tenant)

- Tax Savings – more favorable tax treatment vs. “ordinary” income (i.e. a W2 job)

With 4 different routes to growth, this industry felt manageable. Even if one didn’t work out, I had 3 others, right? Contributing force #3: multiple growth levers.

Diversification

Much of my wealth at the time was my salary, 401K, and RSUs – all of which were directly related to Google. Real estate provided a nice excuse for diversification; if things went south at Google, or broadly in tech, I was highly exposed to that downturn, and that scared me. Doing a side hustle within the tech or ad space felt like it wasn’t removed/uncorrelated enough. Contributing force #4: diversification.

I’m Broke / Leverage

I didn’t have much money, and what I did have was either invested in the S&P or in a savings account, generating 2% APY (remember those days?). When I ran numbers for various side hustles, it was clear that using my money alone to achieve FIRE would take either (1) a long time; or (2) a lot of work. And I was lazy. My co-workers were not, and I didn’t want to be. But I was lazy. And I wanted to continue playing Super Smash Bros. I needed to accomplish this FIRE goal quickly and with little effort – after all, I’m a millennial and don’t know the word “patience.”

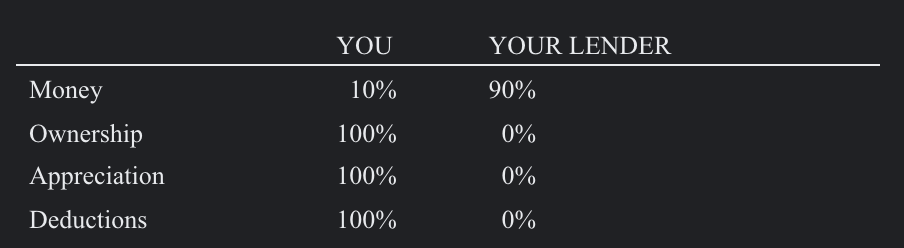

Further research taught me that an accelerant in real estate was using other people’s (or a bank’s) money to compound your investment: leverage. Take an example investor buying a house for $100,000. They can use leverage by only putting a 10% ($10K) downpayment and loaning 90% ($90K) from the bank. This is a 9:1 ratio: every $1 the investor puts in, the bank put in $9. But the investor still reaps benefits at full value:

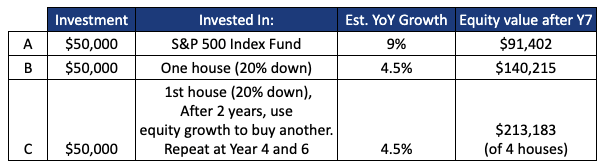

A less aggressive use of leverage would be a 50% downpayment, bringing the ratio down to 1:1. Conversely, an extremely aggressive use of leverage would be to buy with a low downpayment, wait a few years, pull excess money out (using the appreciation) to fund yet another house..and then repeating every few years. Each side of the spectrum has its own risk and reward calculation. Here’s how I charted my three options in my head:

As you can see, even with half the appreciation vs. the S&P (and relying only on the 2nd, “appreciation” growth lever), investing in real estate can be powerful given the catalyst of leverage. Caution: just as leverage can amplify gains, it can also exacerbate losses, so it’s imperative to manage your risk wisely. The above chart sounds beautiful on paper, but there’s much more behind the scenes than the simplistic example results above. Contributing force #5: access to leverage.

Is it right for you?

Turning to you. The biggest concern I’ve heard from apprehensive folks are centered around risk, time, and money. Here’s how I think about some of the questions I’ve received. Drop a line if you have another one you want me to comment on:

“I’m going to buy and it’ll crash / the(my) market is too hot / is right now the right time?”

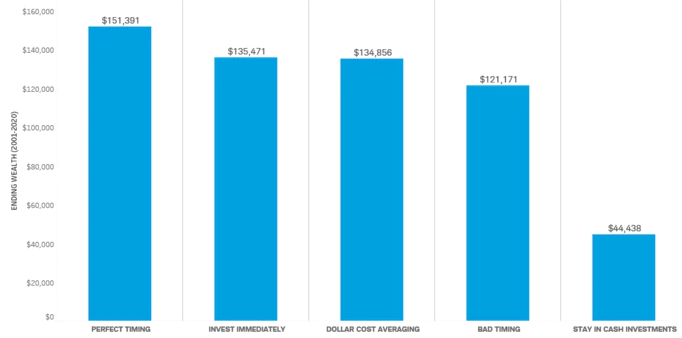

I’ve learned the hard way that timing any market is very difficult. I’ve missed out on many investments by mistiming/waiting. Broader analysis also shows that time-in-market generally outpaces timing-the-market. Here’s the simulated S&P 500 returns of 5 hypothetical individuals (with different investment timing strategies) over the last 20 years. Surprised?

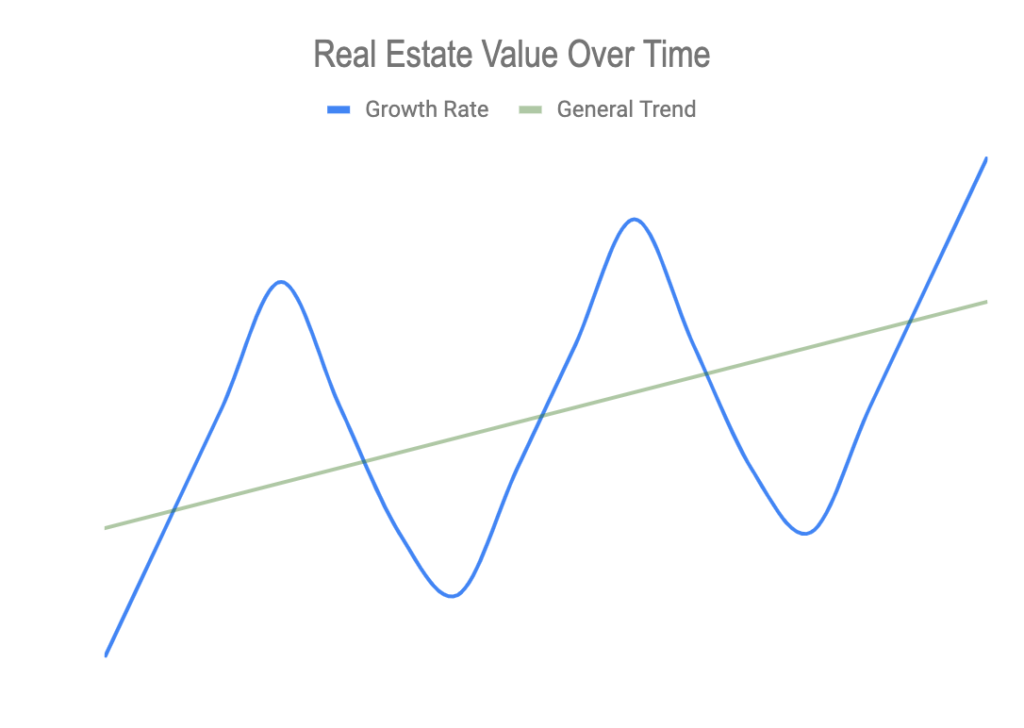

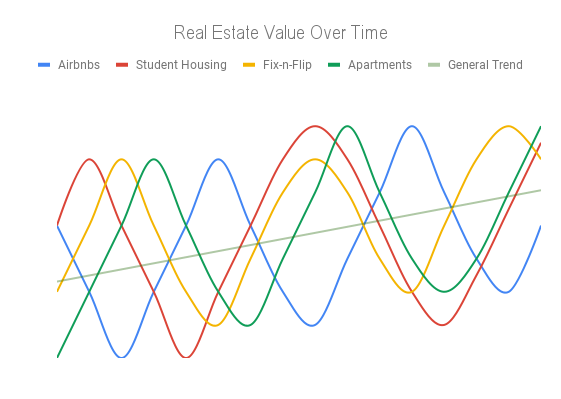

Unfortunately, many people get stuck in the 5th bucket, just waiting for the perfect moment. Even the worst timers (4th bucket) yielded triple the returns vs. those that waited (5th bucket). Despite hearing or knowing this, I know you’ll still try to time your real estate investment—it’s human nature. So here’s another way of thinking. When most people think about real estate cycles, they envision this:

In reality, however, ‘real estate’ is actually an overlay of multiple, usually staggered sectors, like this:

At any given time, there is a sector that is rising, while another is in decline. Look no further than COVID to see this in action. Given desired physical flexibility, liquidity needs, and pent-up consumer travel demand, short and medium term rentals (Airbnb, VRBO, etc) have been on fire! Conversely, supply chain disruption brought prohibitively high lumbar cost, making Fix-n-Flip a less lucrative proposition lately. So if you’re going to time it (again, please don’t), at least do some research to find the sector that is temporarily undervalued and likely to trend back up.

“I don’t have that much time. This will take forever”

Most time needed in real estate investing is front-loaded. While it takes time to build the machine, a well built machine runs for a while..and usually runs passively (this is why real estate is classified as “passive income”).

Even then, you can further reduce your time if you’re willing to allow others to step in; in most cases, it’s a simple tradeoff: time for margin. For example, “I don’t have time to:

- ..go to open houses” — give an agent notes on what you want to see

- ..deal with tenants” — hire a property manager

- ..keep all those records” — find a bookkeeper

When done correctly, managing a real estate portfolio offers a similar development opportunity for a key trait of Product Managers: leading without authority. While I used to hate this idea, I’ve come to respect this challenge and now see real estate investing as an opportunity to grow those muscles outside of work.

“I don’t have enough money”

As with time, you can decide how much money to invest. Here are some briefly-summarized alternatives to traditional real estate investing:

- House-hacking: Buying a larger-than-needed building (duplex, triplex, etc), living in one unit, renting out the rest. Here, you’ll capture the benefits of a significantly lower downpayment (as low as 3.5%) and mortgage rate, while still earning rent from the other unit(s).

- Wholesaling: Getting an offer accepted on a house at below market value (i.e. $300K). Within your closing window, reassigning that contract to another buyer at retail price ($330K) before closing. Essentially, arbitraging the wholesale and retail markets.

- REITs: Real Estate Investment Trusts. Effectively, an index fund with specific focused exposure in real estate.

- Fix-n-Flip: Finding a house in need of rehab, getting a short-term (high-rate) construction loan to fund it, fixing it up, and selling it.

- Syndicate: An experienced operator collects investments from individuals, pools them together, and develops a large-scale project. Upon completion, investors get a share of the rent or sale price. Here’s an example deck.

- Fractional ownership: Pooling ownership with hundreds or thousands of others. Allows you to invest less, while still getting the exposure. Examples include Fundrise and Crowdstreet.

There are resources online specifically addressing how to get into real estate with low or no money down (example book that I have not read). Tread carefully: sometimes, less money invested adds a higher-than-necessary risk for first-time real estate investors.

“What if I need the liquidity quickly?”

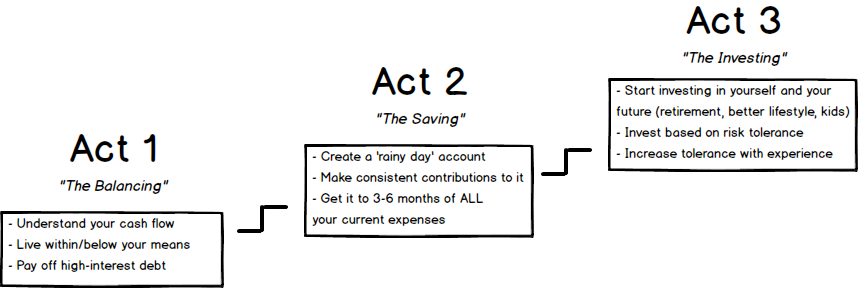

Taking a step back, when those new to investing ask me, this is the 3 stages of life I share (you know I love frameworks!):

So my first response to those who ask me about liquidity needs is: do you have your rainy day account (Act 2) funded? If not, spend some time intentionally building one. Once complete, ask yourself, why do you need additional, immediate liquidity? For most people, it’s a comfort thing. So I simply suggest adding more to that rainy day account before jumping into real estate investing (and Act 3, in general).

For those who are on Act 3, real estate does offer liquidity. Not nearly as much as your stocks, which can be sold and settled within a few days. But your equity in a rental property can also be tapped into (refi, HELOCs, personal loans). In fact, doing so can be less costly, as the interest rate of these products is much lower than capital gains tax liability from selling stock.

However, tapping into your real estate equity takes time (30-45 days). For most readers here though, the liquidity needs for large expenses can be planned (having a child, a home remodel, a car purchase, etc). So with real estate, you still have liquidity: it just requires a little more advance planning.

Some homework

I try to keep these articles actionable. Here are some next steps I’d recommend for anyone that is “on the fence” and still deciding:

1. Stop beating yourself up. Most of you have priorities: family, health, job, etc. Understand that you not having taken the leap already is not because you’re not smart enough. You also haven’t missed some big opportunity either (real estate is not the next Dogecoin). Don’t skip this step. If you do, you may prematurely jump into an opportunity out of FOMO rather than taking a measured approach.

2. Decide your why? Is it for passive income? Is it to gain some experience? Is it a fun side project to occupy your mind from your full-time job? Your answer will directly dictate your involvement and narrow the appropriate type of investment.

3. Make a goal, share that goal. If you’re still interested, what do you want to do next? Keep it micro and time box it. For example, “By June, I want to read one book on managing rentals from out of state.” Share your goal with a friend, partner, or colleague. Sharing out loud makes you subconsciously more accountable and you’ll have an innate fear of letting others/yourself down – use that pressure to your advantage.