The Wall Street Journal article: “Elon Musk Says Twitter Has Had Massive Revenue Drop as Layoffs Begin” Chief of social-media company cites activist groups pressuring advertisers, as many staffers brace to lose jobs

Twitter is an incredible company with a bright future.

But they have done an incredible-ley BAD job of managing their expenses, and since their IPO in November of 2013, they have basically returned zero to shareholders … they went public at around $18B in market cap, and after 9 years they were valid at just north $25B before Elon Musk stepped in to buy them. After dilution and inflation, their shareholders sans Musk received nothing more than they put in after the IPO, even though an investor in the S&P 500 would have tripled her money.

What gives?

Well, as of Q2 2022, Twitter’s earnings report indicated that revenues were up 2% yoy, but that expenses had swelled by 31%. That kind of lack of financial discipline isn’t what investors are looking for, especially as we are likely headed into a steep recession for ad and consumer business.

Musk’s Layoffs

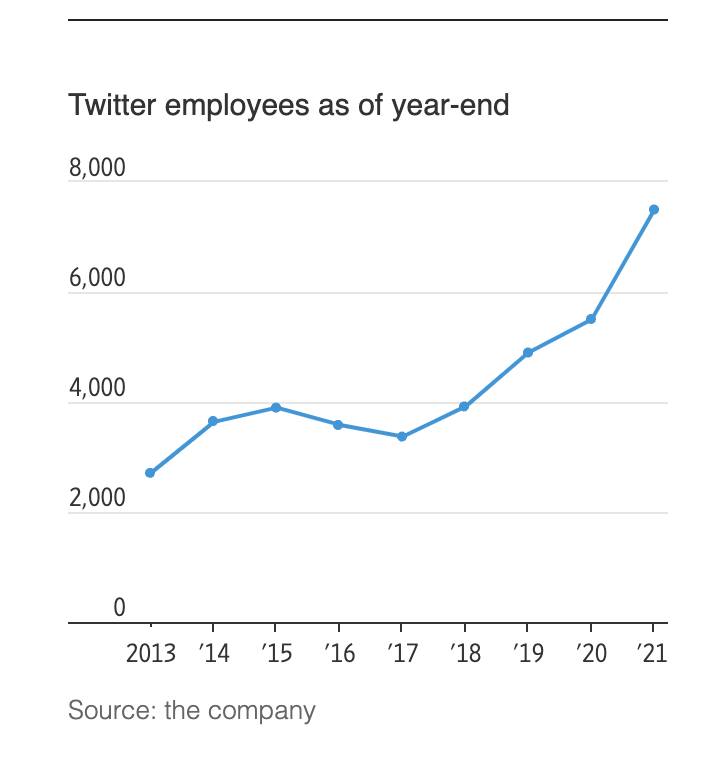

Twitter has now made headlines for laying off about 50% of its workforce–that means around 3,700 affected employees. This is sad and unfortunate, and there are human consequences, but this was a long time coming.

Twitter joins a long list of tech companies recently doing layoffs, including: Stripe, Lyft, Shippo, Opendoor, Chime, Dapper Labs, Gem, Equityzen, Zillow, Mindbody, Cerebral, Roofstock, Clear Capital, Noom, Crypto.com, and WazirX.

50% vs. 15%?

Most of these announcements are in the range of 10-20% of their workforce, which is not nearly enough if we go into a tough recession. Jack Welch used to talk about doing ANNUAL 10% reductions in force as part of his world-renowned management playbook, more a way to ensure performance management than as a cost-control measure. The fact that Silicon Valley companies now are making headlines for 5% RIFs tells you how far we have strayed from that practice, in an era of free money.

The chart below shows that Twitter has grown HC by 2x since 2017—when revenues were growing at +40% CAGR (2017 to 2021) that was tolerable, but as of Q2 2022 revenues were down 1% and cost action was inevitable no matter what.

Revenue per HC by my math at Twitter is about $660,000 in annual revenues per employee.

Compare that to:

- $1.6M at Alphabet

- $850k at Tencent (primarily in Shenzhen, Guangdong)

- $1.6M at META

- Over $2M at Netflix

So that tells me that they probably should have been managing this better, earlier. It’s time for Twitter to get fit, it’s about time that it did, and Elon deserves a lot of credit for recognizing this—the Valley in general needs to develop a stronger operating efficiency, and the cost of capital is not zero any more.

____